My Coop Login

View your current Savings and Loans Online. Login to your account by clicking the button below.

View your current Savings and Loans Online. Login to your account by clicking the button below.

Explore our loan services designed to make borrowing simple, flexible, and reliable. Whether it’s for personal needs or business growth, we’re here to help you move forward with confidence.

“No posts available in the gallery.“

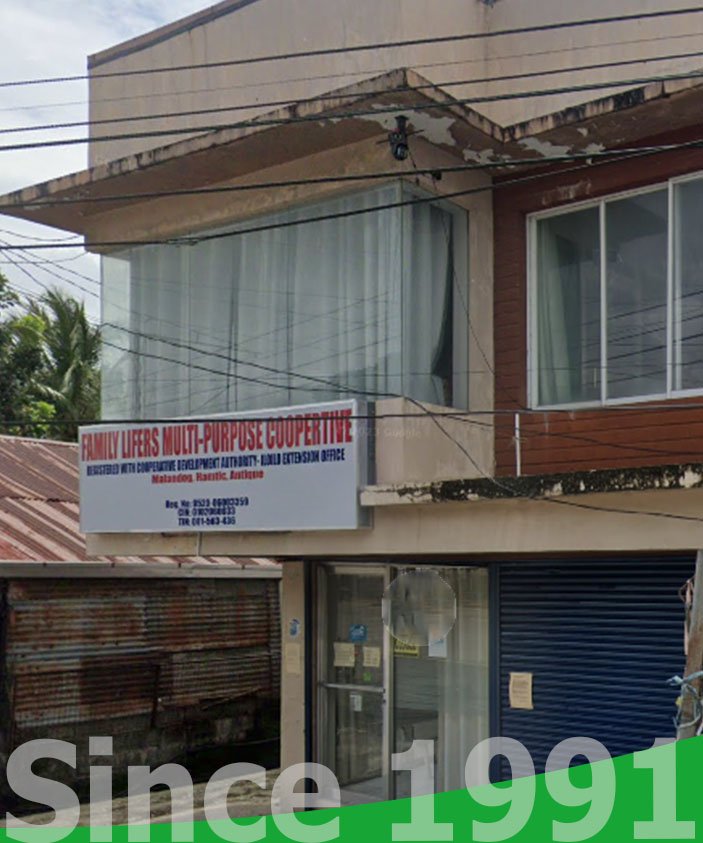

The leadership of Family Lifers MPC originated from a simple story, just like how ordinary people usually start their journey.

In 1991, while we were conducting monthly reunions at Family Life Apostolates, we noticed that sometimes others were absent because they were too busy looking for something they could eat and use for their daily needs. We remember that if we just ignore each of our situations, we won't be able to hide, but if we combine our small capital, talent, and 100% service, we can move forward and help the needs of other members.

We formed FLMPC with only 19 members, each contributing a total capital of P2,700.00. We registered with the CDA on December 26, 1991.

We chose "Family Lifers Coop" as our name because, aside from the fact that the incorporators are members of Family Life Apostolates, we also believe that all people come from one family. We aim to protect and assist in improving the quality of life for everyone.

Establishing and running a cooperative is not just a simple task, as it requires the dedication of time from its officials. Sacrifice is necessary, and challenges are often abundant. However, everything becomes manageable because cooperation within FLMPC is genuinely strong.

If there are ownership meetings, annual assemblies, and Family Day events, everyone attends because the raffle prizes are substantial. Snacks are free, too. That is why we are all happy in Family Lifers MPC.

Our desire is to ensure that FLMPC continues to operate for more than 50 years. We have also envisioned it as a harmonious, prosperous community that fosters quality of life and a strong cooperative supporting the advancement of economic, social, and spiritual aspects of people's lives.

“We Care, We Share”